A lot of disgruntled taxpayers may be smiling now over the prospect that their school property taxes could be eliminated.

But, they shouldn’t get too excited. Even if a planned voter referendum passes this fall and the Pennsylvania Legislature does away with school taxes, it doesn’t mean property owners would stop paying all school taxes immediately.

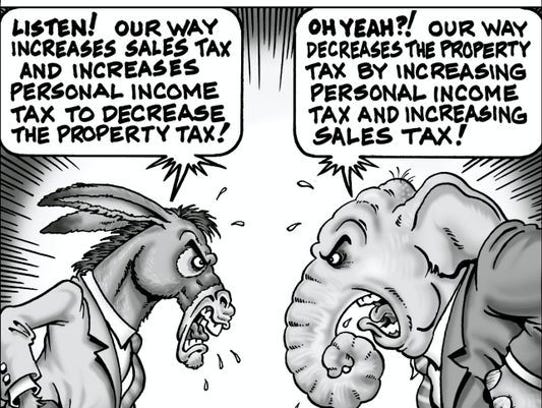

And a pending Pennsylvania Senate bill — The Property Tax Independence Act — calls for increasing personal income and sales taxes as replacement revenue for school districts.

READ: ‘American Pickers’ to film in Pa. this fall

It would allow the districts to continue to levy property taxes for a time — years in most cases — toward paying off outstanding debt.

All 15 school districts that are entirely within York County borders carry millions in long-term debt, generally the consequences of loans and bonds for capital improvements. West York’s $88.7 million debt, for example, is not expected to be paid in full — principal and interest — until 2033.

School taxes have been the bane of many property owners for decades. It was 20 years ago when a constitutional amendment limited the imposition of school property taxes to 50 percent of the median value of homes in the district.

In the years since, there have been interminable arguments, debates and unsuccessful legislative attempts to further limit or eliminate school property taxes. The referendum question is the result of the proposed constitutional amendment being passed twice in the general assembly in 2016 and 2017.

More: Property tax elimination question on November ballot

The November general election referendum will ask voters if the Pennsylvania General Assembly should be given the authority to amend the state Constitution to entirely exclude the taxation of residential properties.

Those percentages vary widely, according to the Pennsylvania Association of School Business Officials, from 11.96 percent in Dallastown Area School District to 47.58 percent in the York City School District. That means, Dallastown taxpayers would see an 88 percent drop in their property taxes, and city homeowners would see a 52 percent drop.

Tossing out those high and low examples, the average property tax rate for York county schools to pay off outstanding debts would drop to 15.46 percent, or almost an 85 percent reduction of current property taxes.

More: Column: Pa. schools need more revenue, not cost myths

Some examples of York county districts’ debt and when it is expected to be paid off are:

Spring Grove Area School District, $88.7 million debt, to be paid off by 2028-29;

South Eastern School District, $34.87 million debt, to be paid off in 2028-29;

Eastern York School District, $42.52 million, to be paid off by 2027;

York Suburban School District, $46.05 million, to be paid off by 2029.

Property tax elimination proposals before the Pennsylvania Legislature call for raising the personal income tax from 3.07 percent to 4.34 percent and the sales tax from .06 percent to .07 percent.

More: Column: Why we need to abolish school property taxes

The higher sales tax also would be imposed on a number of goods and services that currently are untaxed, including: food; clothing and shoes over $50; non-prescription medications; funeral expenses; diapers; child care services; trash collection; public transportation; newspapers and magazines; flags; horses; textbooks; candy; gum; and telecommunications (cellphone plans).

Money collected from those increased tax rates would not go directly to the school district. Instead, it would be collected by the state, which then would distribute it to the districts through the Education Stabilization Fund.

The elimination of property taxes does not include or change property taxes levied by municipalities or the county.

Reasons it will work

From a variety of sources, including the Pennsylvania General Assembly and grassroots taxpayers groups, here are five reasons why supporters of property tax elimination say it will work:

1.) Funds distributed by the commonwealth would be at a one-for-one rate for each district, meaning no district will see a reduction in funding.

2.) Taxpayers who see a reduction in property taxes would see increases in their disposable income. The reduction offsets the higher sales tax.

3.) Inability to pay school property taxes will not result in home foreclosures.

4.) The state will assume responsibility for school funding regardless of district taxpayers’ ability to pay. Proponents say that will bring financial equity to school districts.

5.) Elimination of the property tax removes financial pressure on seniors and retirees living on fixed incomes.

More: How would York Co. schools fare under Wolf budget?

Reasons it won’t work

Opponents of the switch from property tax to personal income and sales taxes for school funding — largely people and groups with ties to education — predict a myriad of problems just as dire as ever-increasing property taxes.

1.) With the state collecting and distributing funding, there will be disparity in the distribution. School districts in Allegheny, Bucks, Chester, Delaware, Montgomery and Philadelphia counties have the highest property taxes, and in the one-to-one replacement funding promise, these districts will receive the lion’s share of the funding. Local tax dollars from increased income and sales taxes will not go to local school districts.

2.) Taxpayers in districts with high debt will see the money they pay for taxes rise as they continue to pay a percentage of property tax to pay off school debt and also pay the increased personal income and sales taxes.

3.) School districts that need to expand or encounter unexpected expenses will have no ability to generate revenue through property taxes.

4.) Personal income and purchases of taxable items rely on the health of the economy. An economic downturn or depression could significantly affect the amount of money available for distribution to schools.

5.) The personal income tax rate is increased from 3.07 percent to 4.34 percent and the sales tax is increased to 7 percent, creating a financial hardship on the middle class.

The public notice issued recently by the Secretary of the Commonwealth announcing the proposed constitutional amendment on property taxes does not address the increase in sales and personal income taxes.

The half-page notice, in fact, makes no mention of what would replace property taxes as the primary source of school funding.

It does, however, include the referendum question as it will appear on the November ballot throughout the Commonwealth.

The question reads: “Shall the Pennsylvania Constitution be amended to permit the General Assembly to enact legislation authorizing local taxing authorities to exclude from taxation up to 100 percent of the assessed value of each homestead property within a local taxing jurisdiction, rather than limit the exclusion to one-half of the median assessed value of all homestead property, which is the existing law?”

If a majority of voters can negotiate their way through the question and approve it, the constitution will be amended to prohibit school property taxes.

Leave A Comment